The stock market, with its tantalizing potential for wealth, often entices retail investors. Yet, the reality is that many find themselves grappling with losses. To demystify this phenomenon, we turn to the fascinating world of game theory. In this article, we’ll employ a game theory-based example to uncover the intricate reasons behind why retail investors may sometimes find themselves on the losing end of stock market investments.

The Game Theory Enigma: Picture a scenario where stock price expectations are depicted by the outcomes of two coins. If both the retailer (that’s you) and the market both flip heads, the retailer pockets $3. If both flip tails, the retailer gains $1. However, if the retailer and the market produce opposite coin sides, the retailer loses $2. On the surface, this game might appear equitable, but there’s an intriguing twist.

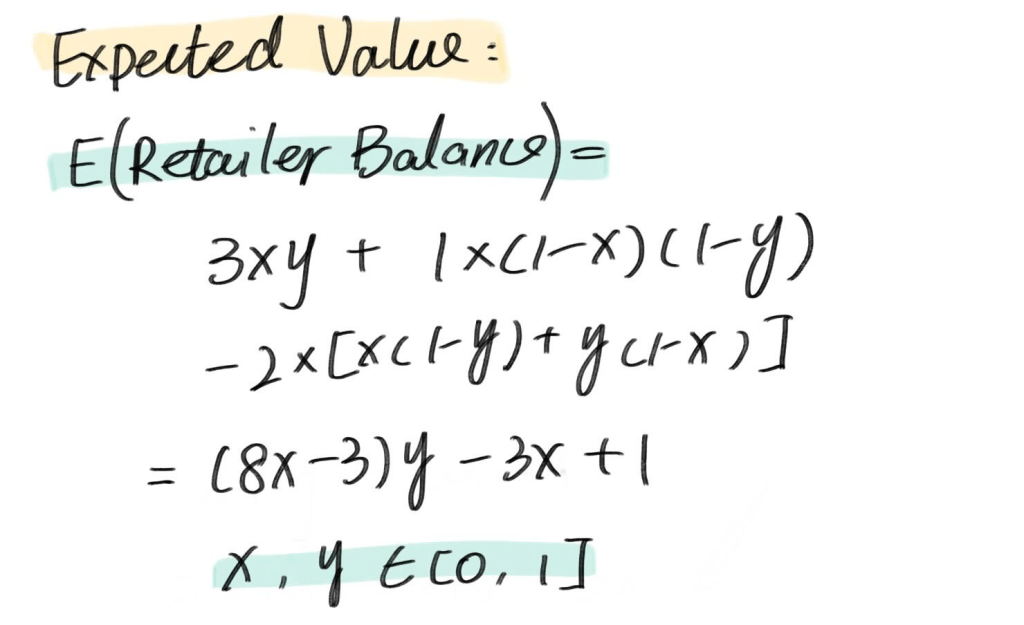

Crunching the Numbers:

To unravel why retail investors sometimes face losses, regardless of their strategies, let’s plunge into the mathematics of the game. We’ll employ the probabilities of the retailer showing heads (x) and the market showing heads (y) to calculate the retailer’s expected balance.

Expected Balance = 3xy + (1 – x)(1 – y) – 2[x(1 – y) + y(1 – x)]

The Quest:

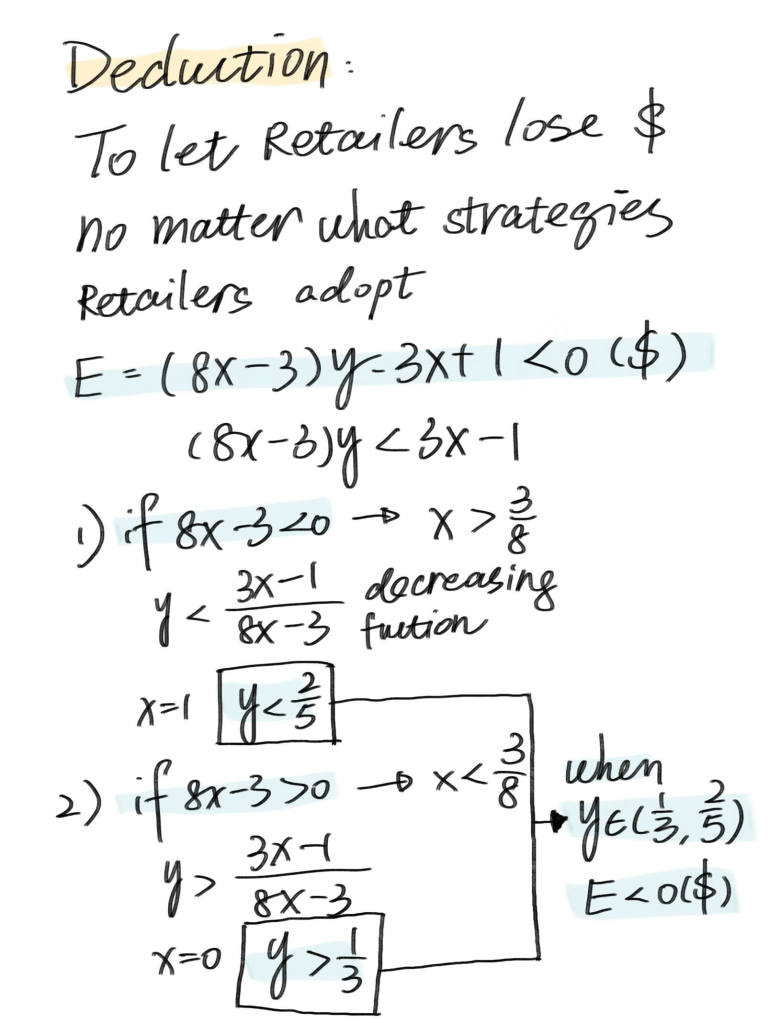

The quest here is to manipulate this equation in a way that ensures the retailer’s anticipated balance consistently dips below 0, signifying that they will lose money over time. To attain this, we must meticulously select values for x and y.

Mastering the Game: After some mathematical wizardry, we unveil a revelation: as long as y falls between 1/3 and 2/5, the retailer’s expected balance perpetually resides beneath 0, no matter what strategy they deploy.

Let me illustrate the math deduction with hand writing on my very slippery tablet surface:

Now, let’s draw parallels between this captivating game theory example and real-world stock market investing:

Unruly Outcomes: Just like our intriguing example, the stock market boasts an array of unpredictable variables and factors.

Market Complexity: Retail investors may not have access to the same resources as institutional investors, leaving them at an apparent disadvantage.

The Emotional Rollercoaster: Investing often unleashes an emotional whirlwind akin to our coin-tossing adventure.

The Illusion of Control: Retail investors may feel as if they are wrestling with market forces beyond their command, akin to the coin toss.

While our example may simplify the complexities of the stock market, it unveils a fundamental truth: retail investors can encounter challenges that cast a shadow on their investment journey. Understanding the market’s intricacies, crafting a meticulously researched, long-term strategy, and embracing risk management can mitigate these challenges.

Leave a comment